A View from the Bridge - Jan 2018

Global growth enters 2018 on a strong footing with confidence surveys at multi-year highs in many regions and inflation expectations still tame but without fears of deflation hindering investment decisions. Strong growth in Q1 should underpin the late 2017 surge in equity and credit valuations, but the outlook for H2 2018 could prove more challenging for asset markets if some of these positive forces plateau or go into reverse.

One of the positive forces for global growth has been near zero interest rates and ongoing balance sheet expansion by the world’s major central banks, keeping their own corporate and household real borrowing rates close to zero, but also allowing for investment flows into emerging economies offering higher returns on growth. Labour market slack accumulated in the aftermath of the financial crisis has allowed for steady employment growth without wage pressures, despite the longer-term demographic headwinds faced by the world’s major economies. With excess capacity now being reduced and expansionary monetary policies being dialled down, these economies will become more reliant on a resumption in productivity and investment growth to maintain their expansions. Inflation remains low in most developed economies, higher oil and other commodity prices are boosting headline rates, but these effects can fade if oil stabilises between $60-$70 per barrel.

Other effects that are more difficult to quantify include the U.S. tax reform legislation passed at the end of last year. Most estimates put the boost to annual growth at about 0.4%, but the sustainability is questionable given that the economy is already operating close to full employment. The Federal Reserve is also in the process of accelerating the reduction of its QE portfolio, alongside ongoing increases in the federal funds rate. Much will depend on how the Federal Reserve acts in response to its own revised estimates following the passing of the tax legislation. The ECB could also wind down its asset purchases more fully over the course of 2018, potentially leaving the Bank of Japan as the only central bank directly trying to support asset prices.

Political risk appears less elevated in the Eurozone following the general elections last year, but Germany is still in the process of forming a new government and Italy will now head to the polls in March, with the risk of an anti-euro party achieving a significant vote share. The risk is that a left-field event coincides with an ECB looking to reduce the pace of stimulus, challenging the relative calm in peripheral bond yields. In the U.S the mid-term elections will take place in November, the first major test for the Republican party under Trump’s presidency, hence the need to pass further legislation early in 2018. Geopolitical tensions simmer, but seem no more elevated than last year, North Korea and the Middle East the areas of risk. Protectionism is a risk for markets if Trump’s post-election rhetoric is followed up with specific action over anti-dumping breaches.

Here in the UK we expect Brexit negotiations to remain a dominant driver of market risk throughout the year. Although parliament will now be given a final vote on the divorce deal, it is not clear as to whether this fully mitigates the risk of an acrimonious departure from the EU. The risk of a direct challenge to May’s leadership from Jeremy Corbyn and from within her own party seems to have subsided for now.

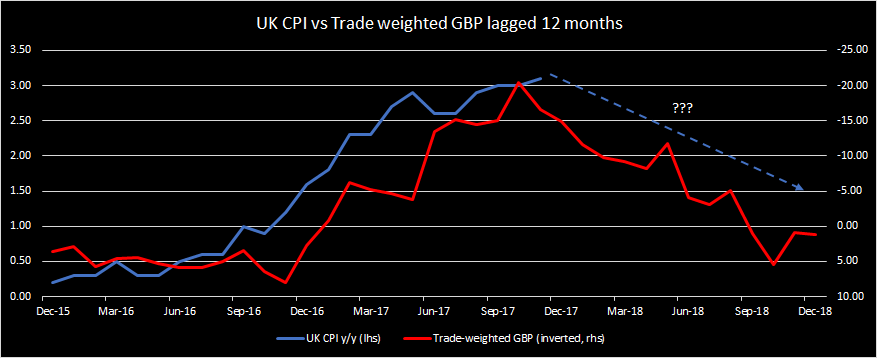

The U.K rate outlook remains fairly benign, labour markets are becoming quite tight relative to historical norms, but weak productivity and Brexit uncertainty are likely to prevent wages accelerating as quickly as would normally be expected, although a slight pickup in pace seems plausible. The one bright spot is that consumer price inflation should decline rapidly in the first half of the year as the effect of prior currency weakness begins to fade, taking household real wages back into positive territory for some much needed balance sheet repair. Markets are pricing one additional 25bp increase in base rate over the next 2 years, so for those looking to hedge against higher rate risk this will look attractive but of course, an adverse Brexit scenario without the inflation impulse could also cause the BOE to question itself over last November’s hike!

PegasusCapital - 25/01/2018

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026