A View from the Bridge - January 2021

So many articles are being written about elements of global stock markets being in a fully-fledged bubble, but past experience suggests that any bursting may still take a little while longer to arrive. Historically the tipping point only arrives when those writing the articles and other commentators reach a point of despair whereby, they or we, begin to seek alternative hypotheses as to how valuations could be validated. As there has been nowhere to hide in terms of portfolio de-risking for what seems like a lengthy period of time, the final outcome could be all the more brutal. Whether we start from the point of a bubble bursting or simply a large-scale correction, either could generate significant systemic issues.

It is often overlooked that these bubble-like market valuations are much more exposed to the economy recovering faster than to the pandemic languishing or intensifying . Liquidity hospitals aka the central banks, have provided nothing less than large doses of daily morphine for markets around the world for over a decade now. The pandemic has therefore been an intensification of process, as opposed to a new paradigm for monetary policy. A form of herd immunity, however scant, from vaccine roll out, will be a joyous event for populations but for many corners of the asset markets it could be a time for “Cold Turkey”, especially as Government borrowing to fund the impact of the pandemic is expected to be on a gargantuan scale for years to come. The outcome of this will be very high levels of government issuance and higher taxes on wealth and corporate profits, which could well be the catalyst for a medium to long-term re-evaluation of current risky asset pricing, not necessarily a crash but a prolonged period of moribund returns.

Then we come to the inflation vigilantes and it’s not at all clear what they are hoping for! Higher inflation being a panacea that would simply reduce existing debts to negligible amounts in real terms , would be disastrous for the discounted value of assets and incomes, triggering a market crash that could exceed that of the risks highlighted above. Poverty levels would likely increase not fall, reducing wealth inequality by asset deflation and lower real incomes is a fool’s errand. With the amount of borrowing and investing governments need to do over the next 10-20-years, the last thing we need is higher inflation, and one would not trust any central banker trying to pretend otherwise. With underlying inflation near zero and targets 2-3% points away, they are no different to euphoric supporters whose team are 2-0 up in a football match but then just look at what happens when the opposition gets one back with 15 minutes to go. We are still some way from that moment but the rise in the latest batch of inflation indicators, and those that will turn up as lockdown is eventually lifted, should be viewed as largely short term.

That said, the most troubling thought is that U.K. monetary policy may still not be easy enough if one looks at the potential impact on households and businesses as government COVID support measures eventually fall away and an assumed recovery occurs as the shutdown sectors reopen. Mortgage rates have been rising recently across many borrower types, somewhat masked by the buoyancy in transactions and prices generated by the stamp duty holiday. Credit availability remains very challenging for small businesses many already fully utilising direct COVID support, credit facilities and also taking advantage of rent holidays.

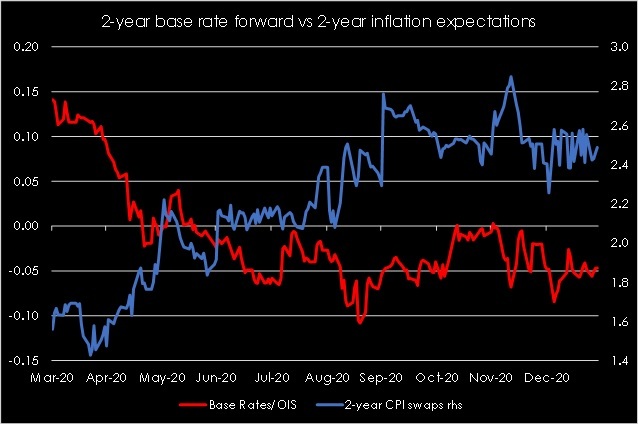

We should therefore not be surprised if there is a growing argument for recalibrating monetary policy away from further increasing long-dated asset purchases towards directly lowering the cost of credit to households and businesses in the coming months. We know the Bank is much closer to finishing its feasibility study into the implementation of negative interest rates and a combination of mildly negative interest rates and targeted lending by the BOE seems much more appropriate than increasing the pace of asset purchases at this juncture. In fact, the House of Lords have just opened an inquiry into the extent of quantitative easing, in itself a possible nudge towards the BOE adopting negative interest rates.

PegasusCapital - 28/01/2021

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026