A View from the Bridge - July 2015

Tough love is sometimes needed and at times it can work; just witness Spain and Ireland where after some rough times both economies are growing at more than 3%, the fastest rate since the crises began. However throwing money or should we say creating more debt will not necessarily provide a long term solution. Eurozone debt has now reached a record high at 92.9% of GDP with Greece, Italy, Belgium, Cyprus, Portugal and Ireland all exceeding 100% and France nearly there at 98%. In a low rate environment the political agenda can supercede fiscal reality but the IMF gave us a timely reminder that reality has to kick in eventually when it announced that it could not participate in the Greek bailout because the sums just don't add up.

In contrast both the UK and the U.S., whilst heavily indebted themselves, are witnessing healthy growth with GDP of between 2 and 3%, which gives both the opportunity to contemplate interest rate rises. Although both Janet Yellen and Mark Carney do not want to be "behind the curve" they both have a number of significant issues to consider. On one hand they still have little or no inflation (until the latter part of the year) and unexpectedly both have seen a drop off in retail sales. Moreover they are acutely aware of the negative impact that a strong currency can have on exporters and their multinational corporates with overseas earnings. On the other hand with new jobs consistently being added every month, home sales in the U.S. Rising at the fastest rate since 2007 and UK mortgage lending at its highest level since the crash, the need to manage the asset bubbles has to be at the forefront of policy decisions on both sides of the Atlantic.

As far as the Global economy is concerned the IMF has downgraded its forecast to 3.3% for 2015 not on the back of Greece but on concerns of the slowdown in China where this month the stock market dropped by over 25%. Elsewhere in the BRIC economies, Brazil is back in recession, and the Russian economy is struggling as it feels the effect of oil prices once again dipping below $50 per barrel. Finally keep an eye on another commodity based country Australia, where a falloff in demand from China could have an adverse impact on indebted households that are more leveraged than those of the US and UK prior to the crash.

Stat of the month: In the UK the percentage of homeowners that own their house outright (33%) exceeded those with a mortgage (31%) for the first time.

The GBP markets continued sideways in near term rates: 3mth closed at 0.58% (0bp) and 6mth closed at 0.75% (+1bp). The curve on Fixed Term rates (longer than 1 year) flattened: 5 Years closed at 1.75% (+3bp), 10 years closed at 2.13% (-4bp), 20 years closed at 2.31% (-7bp) and 30 years closed at 2.27% (-9bp)

The curve on UK Government Bond yields also flattened: The 10 year UK Gilt Benchmark closed at a yield of 1.88% (-14bp) and the 30 year UK Gilt Benchmark closed at a yield of 2.56% (-16bp).

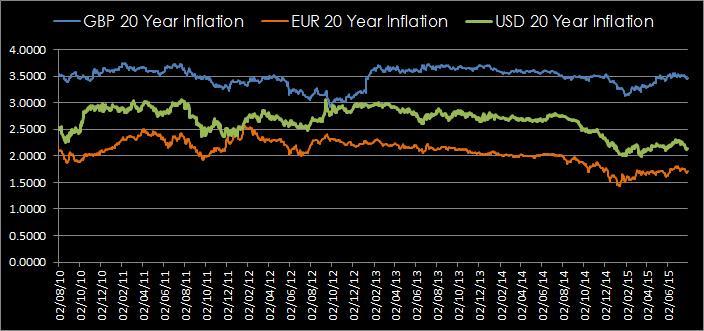

GBP future inflation expectations expressed through 20 year Inflation Swaps ended at the lows of the month, opening at the low of 3.49%, a high of 3.54% and closing at 3.45%.

In the Foreign Exchange Market GBP was lower against the USD$ at 1.5622 (1. 5712) and higher against the EURO at 1.4223 (1. 4103)

Our graph of the month compares the historical movements of the 20 Year GBP, EUR & USD Inflation swaps.

PegasusCapital - 03/08/2015

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026