A View from the Bridge - March 2016

Watching the economy is a bit like watching England play football; some reasonable results and everyone gets carried away with expectation and then it’s back down to earth with a result that was determined by external factors. And so it is with the UK economy as GDP growth for Q4 was revised up to 0.6% giving a 2015 rate of 2.3% however, with “the storm clouds gathering in the world economy” the chancellor revised the GDP forecast for 2016 down to 2.1% from 2.4% and to 2.2% from 2.5% for 2017. With headline inflation remaining stubbornly low at 0.3% and no earnings growth it was no surprise to see the Bank of England maintain rates at 0.5%.

Over in Europe there was a lot more action with the ECB cutting its benchmark rate to 0% and its deposit rate to -0.4% which together with an increase in QE from €60bn to €80bn per month is designed to stimulate the weak economy. That said growth forecasts have been lowered to 1.4% from 1.7% for 2016 and more significantly inflation has been revised downwards to 0.1% from 1%. Not long afterwards Norway cut its rate to 0.5% and said that they would be prepared to go negative, quickly followed by Hungary which became the latest central bank to go negative with rates reduced to -0.05% from 0.1%.

In the US the Federal Reserve Chairwoman Janet Yellen pledged not to let rates go negative as she defended the Fed decision not to raise rates yet on the back of worsening economic data with the US factory sector contracting for the 5th month and consumer spending slowing. It is however the lack of inflation that is holding the Fed back and its view that it would be far easier to correct the mistake of waiting too long to raise rates than it would be to correct a mistake of moving too early.

Facts of the month:

• The UK deficit in Q4 2015 of £32.7bn is the highest since records began in 1955.

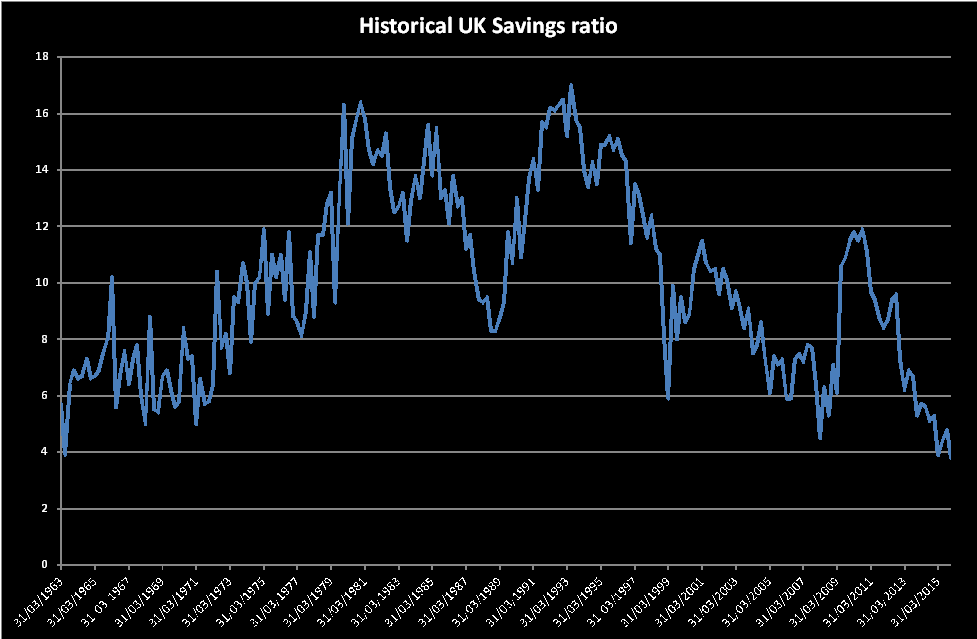

• The savings ratio in Q4 2015 of 3.8% is the lowest since records began in 1963.

The GBP markets continued with static near term rates: 3mth closed at 0.59% (0bp) and 6mth closed at 0.74% (0bp). However Fixed Term rates (longer than 1 year) reversed the recent trend and ended higher: 5 Years closed at 1.02% (+15bp), 10 years closed at 1.43% (+14bp), 20 years closed at 1.69% (+14bp) and 30 years closed at 1.66% (+13bp).

UK Government Bond yields were higher in 10 year UK Gilt Benchmark which closed at a yield of 1.42% (+8bp) but the 30 year UK Gilt Benchmark closed lower at a yield of 2.29% (-2bp).

GBP future inflation expectations expressed through 20 year Inflation Swaps ended slightly higher, opening at the low of 3.20%, with a high of 3.33% and closing at 3.25%.

In the Foreign Exchange Market GBP was higher against the USD$ at 1.4360 (1.3917) and lower against the EURO at 1.2619 (1. 2799)

PegasusCapital - 04/04/2016

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026