A View from the Bridge - May 2016

Could this be the month that everything changes with a big vote in June? Of course it will be a close vote, perhaps too close to call, but it will be the economy that takes centre stage. With oil prices back up to around $50 per barrel creating some inflation, consumer spending up 1% in April on the back of falling unemployment and some wage growth it’s no wonder that many policymakers in the US believe an interest rate rise would be appropriate at the June Fed meeting. However the economic signals may not be clear enough in time and other risk factors such as “the other vote” may be cause market jitters just as the Fed Committee gathers. That said, the markets view as reflected by the Fed Funds futures prices is that June will be too early and that over 50% now see a July rise as more likely.

With all eyes in the UK on a more important vote it may have gone unnoticed that the “economic headwinds” forecast by the Chancellor have hit our shores with 1st quarter economic growth of just 0.4%, driven almost entirely by increased consumer spending, and inflation unexpectedly dropping to 0.3%. The Bank of England in its quarterly inflation report has cut the UK growth forecast to 2% for 2016 and has revised its inflation target of 2% out to mid-2018 and its expectation of a rise in interest rates to 1% out to 2020. Underlying the BoE concerns are; a drop in both manufacturing and construction to a 3 year low, business confidence at a 4 year low, the trade deficit with the EU reaching nearly £24bn and the Chancellor having to borrow £4bn more than forecast.

The forecast in the Eurozone centres on inflation which remains in negative territory for the 4th consecutive month. The outlook has been reduced to just 0.2% for 2016, 1.3% in 2017 and the target 2% inflation backed out to 2020. With key interest rates cut to below zero in the hopes of raising inflation government debt yields have sunk to record lows with the 10 year benchmark German bond close to a yield of 0%. In what may reflect a view that the Eurozone is going to be stuck in a low inflation, low growth pattern for decades to come, investors have snapped up 100 year government bond issues from Ireland and Belgium at a yield of 2.35% and 2.3% respectively, almost on top of the long term inflation target of the ECB.

Fact of the month: Nigerian inflation has reached a 6 year high of 13.7%, some way behind South Sudan and Venezuela where it is approximately 250%!

The GBP markets continued to be unchanged in near term rates: 3mth closed at 0.59% (0bp) and 6mth closed at 0.74% (0bp). Fixed Term rates (longer than 1 year) continued their recent gyrations with the curve flattening: 5 Years closed up at 1.13% (+1bp), 10 years closed lower at 1.52% (-2bp), 20 years closed lower at 1.76% (-3bp) and 30 years closed lower at 1.71% (-5bp).

UK Government Bond yields were lower, 10 year UK Gilt Benchmark closed at a yield of 1.43% (-17bp) and the 30 year UK Gilt Benchmark closed at a yield of 2.22% (-18bp).

GBP future inflation expectations expressed through 20 year Inflation Swaps ended slightly lower, opening at 3.21%, with a high of 3.22%, a low of 3.10% and closing at 3.16%.

In the Foreign Exchange Market GBP was lower against the USD$ at 1.4483 (1.4612) and higher against the EURO at 1.3011 (1. 2761)

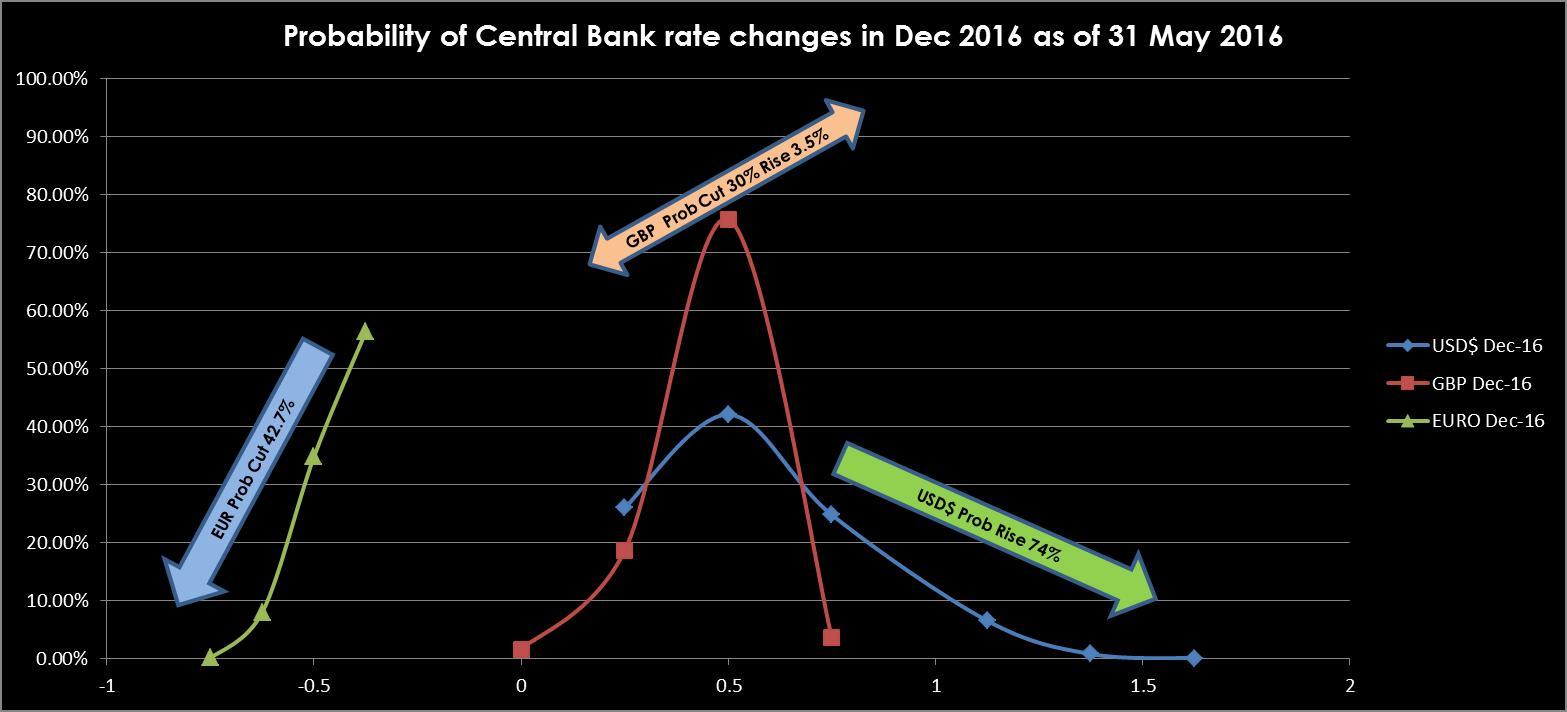

Our Graph of the month compares the probability of Central Bank rates rising or falling for USD, GBP & EURO (horizontal axis is Probability and vertical access is interest rates)

PegasusCapital - 01/06/2016

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026