A View From the Bridge - November 2019

The Bank of England’s monetary policy committee will breathe a sigh of relief that the box of economic fireworks that could have been presented by staffers have likely been downgraded to the indoor variety. Governor Mark Carney is scheduled to leave his post at the end of January (already extended), which coincides with the latest Brexit extension deadline. His likely successor and/or whether he is asked to extend his tenure again will be dependent on the outcome of the December 12th general election. We are likely to see very different candidates appointed in the event of either a Conservative or Labour majority (the latter possibly pushing for a change of mandate), whilst another hung parliament will likely require Mr Carney to stay on until a suitable compromise candidate is found to navigate through the likely prolonged Brexit uncertainty.

Obviously the BOE’s potential to signal any shift in policy stance due to the downshift in future indicators and inflation has been deferred by the calling of an “emergency” general election. Both of the major parties are signalling their intent to loosen fiscal policy significantly in the event that they achieve a working majority, the first time this has happened in 50-years, which would ordinarily point to a continuation of the mildly hawkish stance on future policy rates. However, it is difficult to overstate just how little this all means given that the parties have such divergent views on the principle of Brexit itself or how it is delivered.

In terms of the immediate outlook for the UK economy, activity data continues to imply a significant slowdown from year ago levels, the Markit/CIPS Composite PMI has fallen to its lowest levels since the immediate aftermath of the 2016 Brexit vote. Annualised year-to-date growth to the end of August was reported at 1.4%, the preliminary Q3 data is due for release on November 11th and markets are expecting a healthy 0.4-0.5% increase. The near term resilience in the official growth data versus the sentiment indicators stems from household consumption holding up with support from higher government outlays, full employment, a post crisis high in wage levels and the running down of savings balances. However, there is a not insignificant risk that the UK consumer’s ability to provide ongoing support will begin to fade in the coming months. The number of job vacancies has been falling consistently since the start of the year and the latest survey from XpertHR suggests wage agreements will begin to fall back in the New Year.

The international backdrop has improved slightly since the August Inflation Report, with the US and China dialling down their trade rhetoric and moving towards signing the first phase of a deal. There has also been progress in the Trump administration’s talks with the EU and Japan. Equity markets have reacted positively to the nascent détente, with most international benchmarks (excluding U.K.) making either new all-time highs or new highs for the year. That said, it is difficult to unpick the elements of the rebound in risk asset pricing. Is there rising expectation of a 2020 recovery and a rebound in earnings or is it simply in response to recent monetary policy easing from the Fed, ECB and China and a continuation of the hunt for yield?

Perhaps the more intense discussion amongst the MPC will focus upon how the outlook for inflation is impacted by the recent recovery in the trade-weighted exchange rate and the extent to which it offsets concerns over the build-up of domestic inflationary pressures due to near full employment and weak productivity. We have seen market based measures of inflation decrease significantly since the prospect of an immediate no-deal outcome diminished and parliament moved to support the notion of a Brexit deal in principle. That said, the equivalent economic risks associated with a no-deal outcome will remain in place until Britain’s future trading arrangements with the EU can be ratified under a near tariff-free deal. Lower inflation outcomes can support real household incomes if the employment outlook softens, however, inflation falling below target will give the bank room to ease policy in the event that economic activity remains below trend into the early stages of 2020.

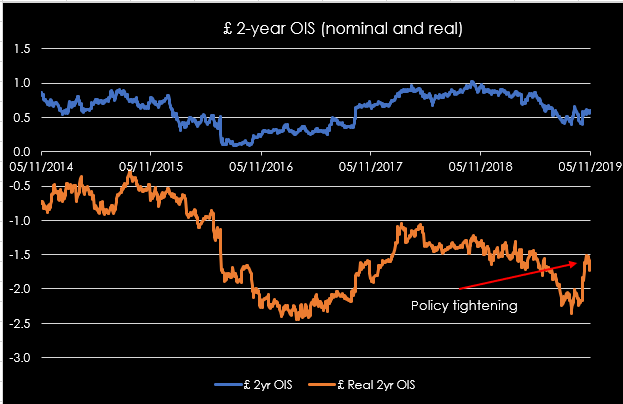

The market is pricing just short of a 25bp cut in the current 0.75% base rate by the end of next year, this is in contrast to the beginning of October when close to two 0.25% reductions were priced. This leaves 5-year swap rates (vs 3m) at 0.71%, up from a low of just below 0.5%. Meanwhile both 2- and 5-year inflation swaps have fallen close to 50bp, leaving implied policy (via real rates) tighter at the BOE’s policy horizon of 2-3 years than the underlying data perhaps warrants, especially when contrasted against recent policy easing elsewhere (see chart below).

Current betting odds are evens for a Conservative majority, slightly wider for a hung parliament at 11/10 and 16/1 for a Labour majority. In the event that a Conservative majority materialises we would anticipate a near immediate ratification of the withdrawal agreement. This could see the currency rally a further 5% with a commensurate bounce in business sentiment, allowing the BOE to revert to its gradual tightening bias initially, but investment spending could remain quite muted until the future arrangements are agreed and the cliff edge avoided with agreement in July next year, notwithstanding that inflation expectations could fall sharply again in the interim. A hung parliament means either a Conservative or Labour led coalition but in the interim (assuming Cons the largest party) would create more uncertainty over both Brexit and the economic outlook. Both the currency and the ability to enact the desired fiscal stimulus will determine how aggressive the BOE policy response needs to be in such a scenario.

PegasusCapital - 05/11/2019

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026