A View from the Bridge - October 2015

65% of economists from leading banks and financial institutions around the world expect the US to raise interest rates in December and the Federal Reserve after its October meeting signalled as much to the markets. However, with inflation still below target, GDP growth slowing to 1.5% in Q3, exports dropping 2% because of the stronger dollar and not as many jobs being created in September, there are reasons for caution. That said, US retail spending was up 3.2% in Q3 and sales of existing houses jumped 4.7% in September so there could be a need to dampen domestic demand.

The IMF and the OECD have both warned that the world cannot spend its way out of trouble and that rates need to be kept low to avoid another crash. The IMF points out that there is $5 trillion of “over-borrowing” and has warned of financial and economic contagion based on emerging markets vulnerability, legacy issues still confronting the advanced economies and weak market liquidity.

Whilst the US may be contemplating a rate rise, around the world Governments are trying to combat deflationary pressures and slowing economies by reducing interest rates as in China where they are down to a record low of 4.35% or increasing QE as they have done in Sweden by a further SEK65bn. The ECB has signalled that it too will take further action in December by increasing its QE programme or even reducing the record low interest rate from 0.05%. Some other countries have made no decision either way such as in Japan where growth forecasts have been cut from 1.7% to 1.2% and inflation to just 0.1% from 0.7% and in Brazil and Russia where GDP has decreased by 2.6% and 4.6% respectively.

The Bank of England made no change to rates in October and with inflation falling back below 0% there is still scope according to one member of the MPC for rates to go lower. Although UK GDP increased by only 0.5% in Q3, the IMF says the UK economy remains solid and forecasts 2.5% growth in 2015 and 2.2% in 2016. With unemployment dropping to a pre-crisis low, consumer confidence at a 4 year high, retail sales up 6.5% year on year and lending to UK consumers up 3.1% in September, the UK is more likely to track the US lead than follow the rest of the world.

The GBP markets continued to be on hold in near term rates: 3mth closed at 0.58% (0bp) and 6mth closed at 0.73% (-2bp). The curve on Fixed Term rates (longer than 1 year) was again higher: 5 Years closed at 1.49% (+5bp), 10 years closed at 1.93% (+8bp), 20 years closed at 2.17% (+7bp) and 30 years closed at 2.15% (+6bp)

The curve on UK Government Bond yields was also up: The 10 year UK Gilt Benchmark closed at a yield of 1.92% (+16bp) and the 30 year UK Gilt Benchmark closed at a yield of 2.62% (+15bp).

GBP future inflation expectations expressed through 20 year Inflation Swaps ended higher on the month, opening at 3.38%, with a low of 3.34%, a high of 3.44% and closing at 3.42%.

In the Foreign Exchange Market GBP was higher against the USD$ at 1.5428 (1. 5128) and higher against the EURO at 1.4020 (1. 3532)

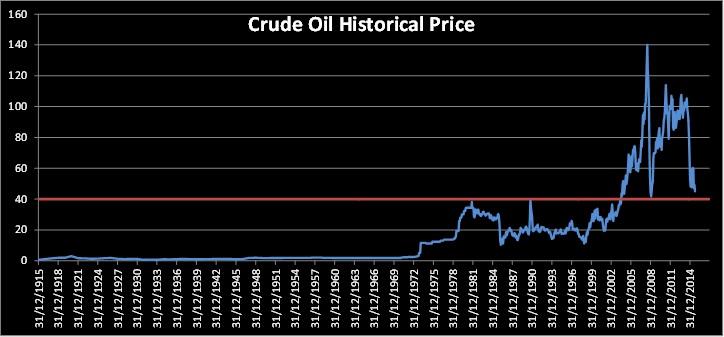

Our Graph of the Month shows that the Monthly Crude Oil price is currently trading just above a strong support level which has historically been both a resistance and support in previous major crises.

PegasusCapital - 02/11/2015

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026