A View from the Bridge - September 2015

With the 3rd largest sporting event in the world kicking off this month it’s not been so much about the curved ball as it has been about the slow ball! The referees (World Bank/IMF) have been calling for a delay in US interest rate rises to try and avoid a big hit on emerging markets and raising the possibility of a new credit crunch! Analysts have warned us that China is leading the world into a global recession despite growth across the G20 economies remaining static at 0.7% in Q2. However, Chinese industrial production has slowed to 6.1% (6.4%) and the manufacturing index has fallen to a 6 year low which amongst other things, prompted the OECD to cut its Chinese growth forecast to 6.7% this year and 6.5% for 2016. Meanwhile, despite the devaluation last month the Chinese central bank has used a record $94,000,000,000 of foreign exchange reserves protecting the Renminbi.

It wasn’t just the China slowdown factor that caused the US Federal Reserve to delay a rates rise but the mixed domestic picture also presented them with a dilemma. Having seen Q2 GDP revised upwards last month, new data showed US retail sales slowed to 0.2% (0.3%) home sales fell 4.8% in August and that exporters are struggling due to the strength of the US dollar and the slowdown in the global economy. According to the World Trade Organization, global growth is likely to be only 2.8% this year against a forecast of 3.3% and as against an annual average double that before the financial crisis.

With oil prices hovering under $50 per barrel, food prices showing the largest decline since 2008 and commodity prices tumbling, nobody appears to be able to shrug off the spectre of deflation at the moment. Japan has again dipped into negative territory and is likely to fall back into recession, India is experiencing year on year deflation of 5% resulting in a reduction in interest rates of 50 basis points and the Eurozone is back in negative territory at -0.1% putting further pressure on the European Central Bank to increase its QE programme.

Question of the month: If Jeremy Corbyn can win the Labour leadership at odds of 200-1 can Samoa or Japan beat the same odds and lift the Webb Ellis trophy later this month?

The GBP markets continued to be on hold in near term rates: 3mth closed at 0.58% (-1bp) and 6mth closed at 0.75% (0bp). The curve on Fixed Term rates (longer than 1 year) was again lower: 5 Years closed at 1.44% (-14bp), 10 years closed at 1.85% (-12bp), 20 years closed at 2.10% (-8bp) and 30 years closed at 2.09% (-8bp)

The curve on UK Government Bond yields was also down: The 10 year UK Gilt Benchmark closed at a yield of 1.76% (-20bp) and the 30 year UK Gilt Benchmark closed at a yield of 2.47% (-11bp).

GBP future inflation expectations expressed through 20 year Inflation Swaps ended lower on the month, opening at 3.44%, with a low of 3.35%, a high of 3.47% and closing at 3.38%.

In the Foreign Exchange Market GBP was lower against the USD$ at 1.5128 (1. 5391) and lower against the EURO at 1.3532 (1. 3792)

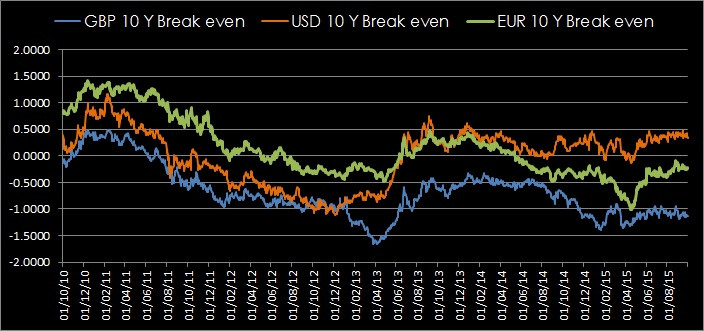

Our Graph of the Month shows the 10 Year Break even rates calculated by subtracting the 10 Year Inflation-linked Swaps from the Generic 10 Year Interest Rate Swaps.

PegasusCapital - 01/10/2015

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026