A View from the Bridge - April 2014

In the month when it has been reported that after a century of domination the American economy is about to be overtaken by China, it is still the US that calls the shots in the financial markets. Even as the US recovery only inched forward in Q1 by 0.1% (v target of 1%+) the Fed brushed that aside as a temporary blip and cut its economic stimulus programme (QE) by a further $10bn to $45bn, saying that the recovery was now back on track. That said, it also announced its intention to keep interest rates low until at least 2016 and to focus on reducing unemployment and encouraging investment.

With the UK economy expanding by 0.8% in Q1, inflation dropping to 1.6% and unemployment dropping to 6.9% it would not be unreasonable to expect a similar strategy from the Bank of England. However, in reality we have a bit of a pull/push dynamic impacting the UK economy. On the one hand we have a consumer led domestic recovery with retail spending up 4% and house prices rising by 10.9% in April, yet what we need (according to the IMF) is a stronger export led recovery. That is a tall order however as our exports hit a 3 ½ year low with GBP strengthening against both the USD (4yr high) and EUR (2yr high), making our exports more expensive to our major trading partners.

QE or not QE?…that is the question for the Eurozone. Although inflation has risen slightly to 0.7% from 0.5% last month, the outlook remains deflationary as companies halt investments and consumers put off spending on non-essential purchases. The key figure of course is Germany, where lower inflation of 1.1% (v target 1.3%) is troubling for the peripheral countries that are slashing their costs to try and improve their competitiveness. Falling inflation in Germany will mean that they have to adjust costs even further, increasing the overall deflationary outlook.

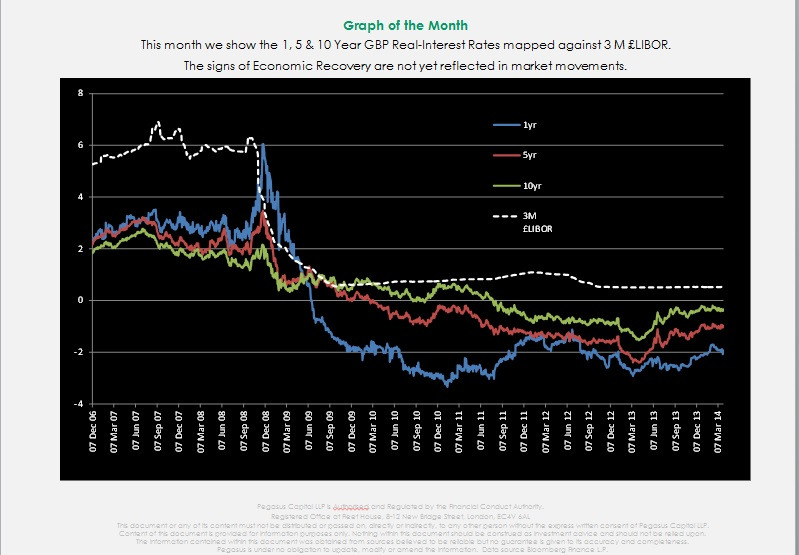

In the markets, near term rates continue to move sideways: 3mth closed at 0.53% (+0bp) and 6mth closed at 0.63% (+1bp). Fixed Term rates (longer than 1 year) were mainly lower across the maturity spectrum: 5 Years closed at 2.06% (+0bp), 10 years closed at 2.77% (-6bp), 20 years closed at 3.23% (-4bp) and 30 years closed at 3.28% (-4bp)

UK Government Bond yields also drifted lower: The 10 year UK Gilt Benchmark closed at a yield of 2.66% (-8bp) and the 30 year UK Gilt Benchmark closed at a yield of 3.45% (-7bp).

GBP future inflation expectations expressed through 20 year Inflation Swaps traded within a tight range over the month opening at 3.61%, with a low of 3.56% and closing at 3.60%

In the Foreign Exchange Market GBP was higher against the USD$ at 1.6875 (1.6750) and slightly higher against the EURO at 1.2167 (1.2109)

PegasusCapital - 01/05/2014

Whitepapers / Articles

A View from the Bridge - February 2026

PegasusCapital - 06/02/2026